Upload Invoice. Unlock Captial

Are you tired of hearing these answers when looking for finance to grow your business?

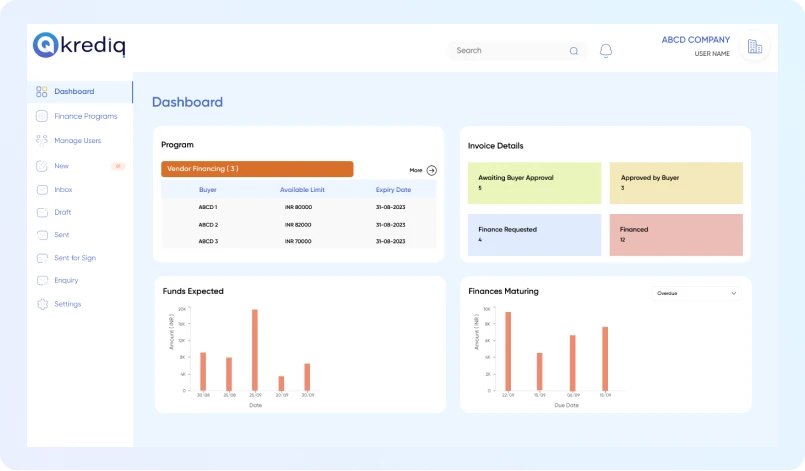

Complete our 100% online application form

We will evaluate your application and sanction a fair credit limit

Onboard to our digital platform and upload invoices

Receive payment of your invoices within 24 hours as per the credit terms